Here's to a new week and new beginnings! But before we begin, there is a new poll to the right and I would really appreciate it, if the regular readers could take a moment to answer it. And if you are new to this blog, maybe you will go through a few posts and answer the poll too. Its been two weeks since I started this blog and it would be nice to have the feedback. Thanks!

That being said, where do I see the markets heading next week? Given the severity and the extent of the fall in the last three sessions, I expect there to be a bounce early in the week. Let me present to you a chart to state my case for a bounce.

The chart below shows the NYSE Advance-Decline Issues. As you can see, we are well into the oversold region, so it won't be too out there to expect a bounce either Monday or Tuesday. But if there is one thing that we learnt as traders from 2008-09, it is that oversold can very easily become more oversold.

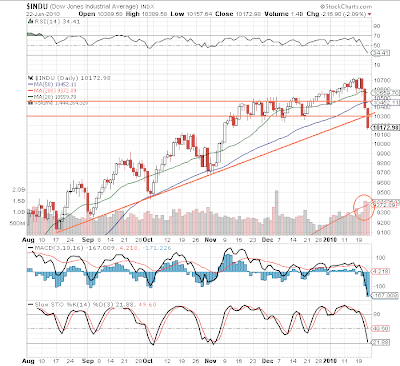

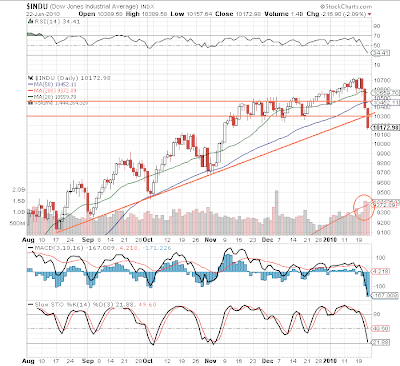

Do I expect this bounce to last? In word one, no. Let me back my reasoning again by some charts. Take S&P for example. Look at the amazing volume to the downside in the last two trading sessions. This is not your normal pullback and could very possibly be start of a major correction. Look out for the volume of any possible bounce. A low volume bounce could be a good opportunity to go short. I have marked possible resistance regions on all three charts below. I wouldn't be surprised to see a low volume bounce to around the 50MA region and then down we go again. Its pretty much the same story for DJIA and NASDAQ charts too.

Personally speaking, I have to try and get out of the rut I have fallen into in the last two weeks. So, I have decided I will be trading small and trading less until I get my confidence back. Wish me luck! There are many blogs out there which claim unbelievable gains and hardly any losses, but in how many blogs do you actually get to see and experience the journey of a trader trying to get out of a losing streak? :) Hopefully, my experiences will be of some help to a few of you readers too!

Take care and good luck!

The chart below shows the NYSE Advance-Decline Issues. As you can see, we are well into the oversold region, so it won't be too out there to expect a bounce either Monday or Tuesday. But if there is one thing that we learnt as traders from 2008-09, it is that oversold can very easily become more oversold.

Do I expect this bounce to last? In word one, no. Let me back my reasoning again by some charts. Take S&P for example. Look at the amazing volume to the downside in the last two trading sessions. This is not your normal pullback and could very possibly be start of a major correction. Look out for the volume of any possible bounce. A low volume bounce could be a good opportunity to go short. I have marked possible resistance regions on all three charts below. I wouldn't be surprised to see a low volume bounce to around the 50MA region and then down we go again. Its pretty much the same story for DJIA and NASDAQ charts too.

Personally speaking, I have to try and get out of the rut I have fallen into in the last two weeks. So, I have decided I will be trading small and trading less until I get my confidence back. Wish me luck! There are many blogs out there which claim unbelievable gains and hardly any losses, but in how many blogs do you actually get to see and experience the journey of a trader trying to get out of a losing streak? :) Hopefully, my experiences will be of some help to a few of you readers too!

Take care and good luck!

No comments:

Post a Comment